FKP co-hosted by Tax Education and Research Center (TERC) LPEM FEB UI on Tuesday, 3 September 2024 with speakers Christopher Hoy (The World Bank), Filip Jolevski (The World Bank), Anthony Obeyesekere (The World Bank) and chaired by Christine Tjen (TERC FEB UI)

Tax evasion by businesses in middle-income countries like Indonesia is often seen as a major reason why their revenue as a share of GDP is much lower than in high-income countries. Indonesia also trails behind similar nations, such as the Philippines, Cambodia, and Malaysia. Between 2009 and 2019, Indonesia collected less than two-thirds of the average revenue for Emerging East Asia and less than half of what other Emerging Market economies gathered. Even though Indonesia has tax policies similar to its neighbors, its tax revenue is still several percentage points lower. Additionally, the country’s revenue as a percentage of GDP has been on the decline, dropping from about 20 percent in 2009 to 15 percent by 2019. Weak tax compliance is often pointed to as a major reason for this ongoing decline in revenue collection.

So, how pervasive is tax non-compliance in Indonesia?

Christopher Hoy (The World Bank), Filip Jolevski (The World Bank) and Anthony Obeyesekere (The World Bank) presented their study on estimating the extent of tax evasion in Indonesia. The data used for this researched came from The World Bank Enterprise Survey (WBES), a firm-level survey of a representative sample of an economy’s private sector. The surveys cover a broad range of topics related to the business environment including access to finance, corruption, infrastructure, competition, and performance. The data is publicly available by signing up for an account.

Top managers or owners of 2,955 firms were interviewed for this Survey. They comprise of a nationally representative of firms possessing a Company Registration Certificate or Business Identification Number with five or more employees with at least 1 percent of private ownership and who do not have legal status as cooperatives.

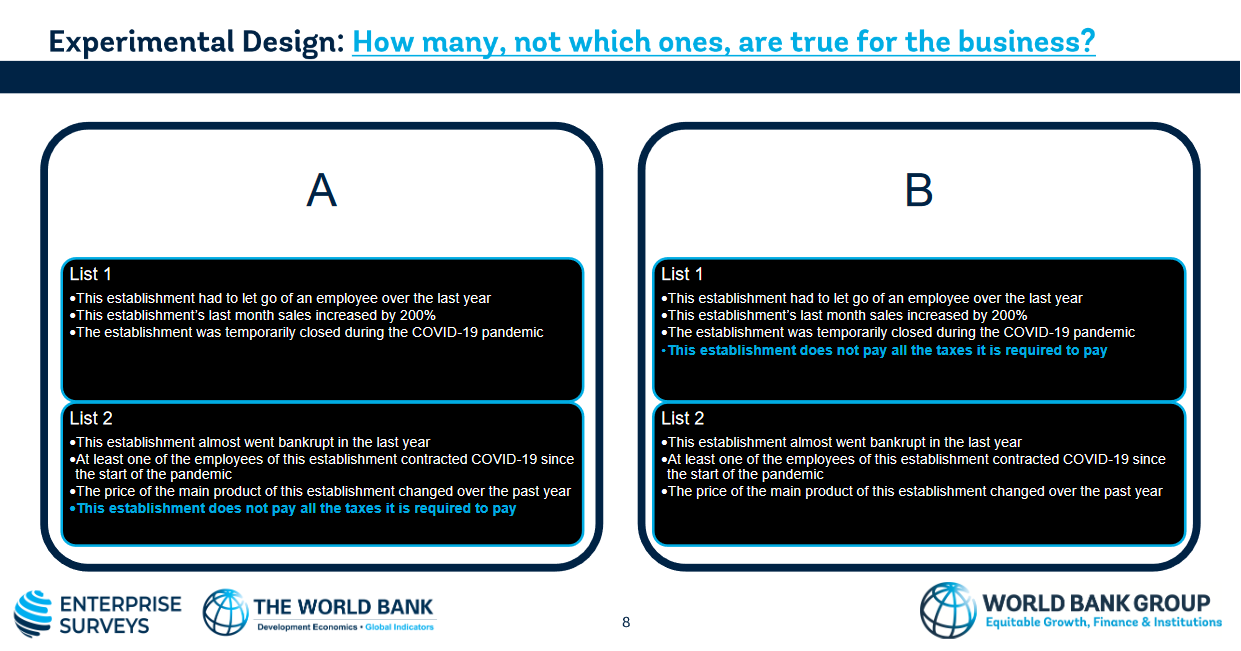

The interview uses a double list experiment method where respondents are separated into to groups and were given a set of statements. Respondents were asked how many statements apply to their company (without the need to identify which of the statements apply). For one of the groups, an additional statement about tax evasion is included (see figure above). Researchers then compare the answer between the two groups.

Based on this research, it’s estimated that around 25% of firms in Indonesia evade paying taxes, leading to a back-of-the-enveloped estimate of revenue loss of around 2% of the GDP.

For more details about the research and its findings, please refer to the open access working paper (click here).