On Thursday, 4 April 2019, The Indonesian Institute of Sciences (LIPI) hosted the first FKP seminar of the month, which included presentations on two topics: 1) the challenges and opportunities of financial technology (fintech) for small and medium enterprises (SMEs), and 2) the effects of cash transfer program for poor students on children’s labor market participation.

Yeni Saptia (P2E LIPI) started the first session by explaining the importance of SMEs for the Indonesian economy. SMEs make up over 90% of all business in Indonesia, yet their access to financial services is still limited. LIPI’s survey in 2013 showed that 80% of SMEs’ source of capital comes from the owners’ personal funds. Bad credit risk and banks’ rigid credit requirements are the main obstacles for MSMEs to gain more access to formal credit sources. The persisting gap between formal financial institutions and SMEs pose a new opportunity for financial technology (fintech) as an alternative source of funding. This opportunity is supported with the fact that around 50% of Indonesia’s population are active users of the Internet.

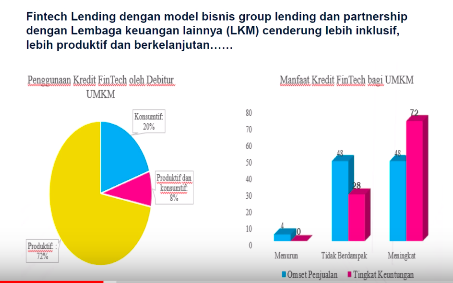

Yeni’s qualitative study was done through series of interviews with SME owners in the tourism sector in Bali and West Nusa Tenggara. This study divides fintech lending companies into two categories: peer to peer (P2P) and linkage with other financial institutions (e.g. cooperation, banks, etc). P2P is usually characterized by lenders’ individual decision on who will receive funding, whereas the latter collaborates with another financial institution that will help in assessing the risks of the potential borrowers. Through the interviews, Yeni found that P2P borrowers tend to use fintech lending services for precautionary and consumptive purposes. On the other hand, fintech lending companies linked with a financial institution tend to have borrowers that use the service for productive purposes. This study also found that most fintech lending consumers choose the service due to its flexibility and the ease of withdrawal. Many consumers do not care about the interest rate, as long as they can withdraw the funds easily.

The next speaker was Achsanah Hidayatina (P2E LIPI) who presented her research on the impacts of the government’s cash transfer program for poor students on their labor market participation in Java. Cash transfer programs has been a popular policy tool in the last decade used by developing countries to improve the quality of human capital. In Indonesia, the government has implemented both conditional and unconditional cash transfers, which are Program Keluarga Harapan (PKH) and Bantuan Siswa Miskin (BSM), respectively. This study focuses on the latter, which is a cash transfer program for poor, school-aged children.

This study assumes that BSM increases school participation, which will, in turn reduces their participation in the work force as an underage labor. Achsanah uses data from the 2015 Indonesian Family Life Survey (IFLS) and restricted the respondents to 6 provinces in Java, yielding over 4,500 children of interest, 21.47% of which are recipients of BSM.

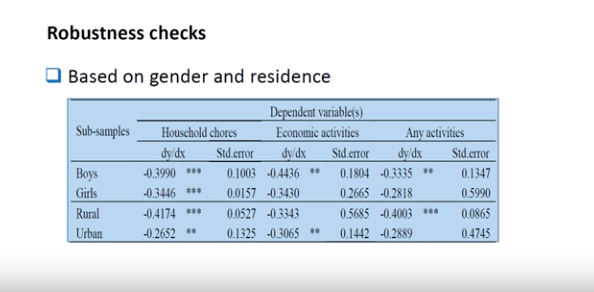

An important finding from the study is that BSM reduces the probability of participation in 1) household chores by 34%, 2) economic activities (i.e. activities that yield economic benefits) by 28%, and 3) any activity by 32%. Despite equal amount of funds for girls and boys, the impact is greater for boys, which may be explained by cultural factors. Moreover, children in rural areas are also more greatly affected by the policy than urban children.

For the complete presentation and Q&A session, please refer to the video and materials provided.