The government of Indonesia has committed to increase and improve social protection programs for all layers of the society. Despite these efforts, some groups remain vulnerable. On Thursday, 3 October 2019, The SMERU Research Institute hosted the first FKP event of the month discussing the future of Indonesia’s social protection programs. The speakers were Elan Satriawan (Indonesian National Team for the Acceleration of Poverty Reduction or TNP2K), Luhur Bima (The SMERU Research Institute), and Krishna Syarief (BPJS Ketenagakerjaan).

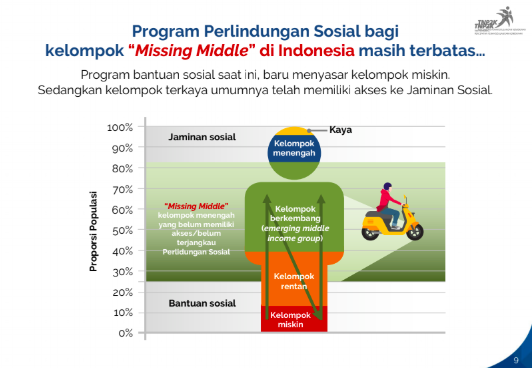

Elan Satriawan started the panel with insights from his policy proposal book on strategies of improving social protection programs in Indonesia. Despite the rapidly falling poverty rate, around 40% of the population are vulnerable to various shocks throughout their lifetime and could easily fall into poverty. This condition is referred to as Indonesia’s “missing middle”. The Social Protection Program for the “missing iddle” group in Indonesia is limited; current programs mostly target the poor, whereas the richest groups generally have access to private programs. As a solution, Elan believes that Indonesia’s social protection programs need to gradually cover every stage of life. He proposed some improvements to the current social protection system, which include benefits for the elderly and people with disability, the integration of Smart Indonesia Program (Program Indonesia Pintar or PIP) and the conditional cash transfer program (Program Keluarga Harapan or PKH), increase the enrollment in the employment social security program (BPJS Ketenagakerjaan), and increase the enrollment in the national health insurance for all age groups. If successful, the proposed program is estimated to reduce the poverty rate from 10.64 (status quo) to 7.2%, with the most significant decrease in the elderly group. The Gini ratio is also estimated to fall from 1.392 to 0.380.

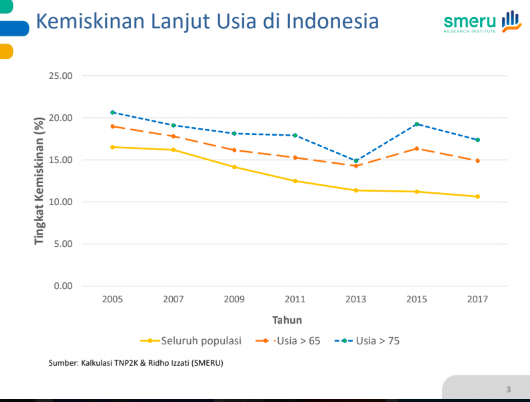

Next, Luhur Bima presented his study on the factors that influence people’s participation in pension program in Indonesia. People over the age of 65 contribute to a high proportion of the poor population in Indonesia, yet few participate in the pension program. Using the fourth and fifth wave of the Indonesian Family Life Survey, Luhur analyzed people aged 18-65 (in 2007) in 13 provinces in Indonesia. Luhur found that being a member of a labor union increases the chance of a person to be covered by a pension plan. Those who own financial products are also more likely to have a pension plan. Conversely, those who own a business are less likely to participate in the program, due to Government Regulation No. 45 of 2015, which defines participants of the pension program as employees. Luhur recommended the collaboration between the government and financial institutions, labor unions, and employers to expand the reach of pension plans, and the revision of the government regulation to also include business owners.

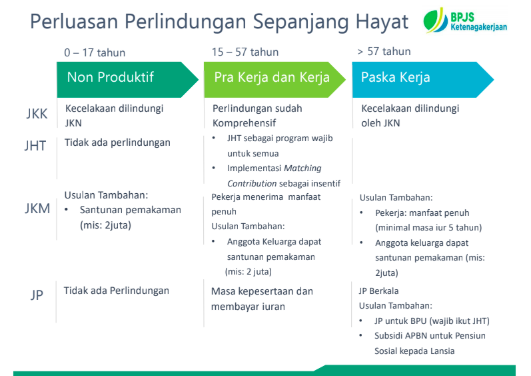

Finally, Krishna Syarief shared insights from the perspective of the government. To give a better understanding of the current state of social protection, Krishna explained the challenges that are faced by different programs. Currently, the pension program (JP) is not available to unpaid workers, and the replacement ratio remains low. Aside from the pension program, the government also has an old-age plan (JHT), which has yet to become mandatory for unpaid workers. The rate of contribution of this program is also low. Next, the benefits from the work accident security program (JKK) are already considered comprehensive, yet cases of handling occupational diseases remain low. In addition, the death security program (JKM) only applies for active workers (under 57 years old). These programs will be expanded to cover all stages of life. To improve the financing scheme of the programs, the government will restructure the regional budget and will optimize the investment of JKK and JKM investment funds, combined with state budget subsidies.

For the complete presentation and Q&A session, please refer to the video and materials provided.