Despite many hurdles and challenges such as the financial crises in the late 90s and 2007-2008 and the taper tantrum in 2013, Indonesian economy has constantly managed to prevail. However, significant risks still remain. On Thursday, 16 May 2019, Febrio Kacaribu (LPEM FEB UI) presented his paper assessing Indonesia’s current crisis management framework, which was published in the Bulletin of Indonesian Economic Studies (BIES).

Febrio began by giving an overview of the Indonesian economy. The current administration’s ambition in developing infrastructure poses several challenges. Almost 50% of the IDR 4,000 billion-worth of infrastructure projects are funded by the government or state-owned companies (BUMN), causing a sudden surge of financial burden in a short time. Febrio believes that the current state domination is unhealthy. The government should allow more private companies to invest and leave behind their China-oriented model of state capitalism. Next, regarding the banking sector, Indonesia enjoys a solvent banking system due to the higher capital buffer and lower overall non-performing loans (NPLs). However, Indonesia still faces a savings-investment gap, which caused a lot of capital outflow. The current savings rate is around 33-35% of the GDP, while investment is around 38% to achieve a 5.5-6% growth. Government debt remains safe at around 30% of the GDP. However, Febrio stated that the government needs to be cautious of the high interest rates due to Indonesia’s rating (Triple B Minus). As a result, interest rates account for around 11% of the state budget (APBN). The best strategy, according to Febrio, is to maintain a discipline fiscal deficit, and maintain a null primary balance.

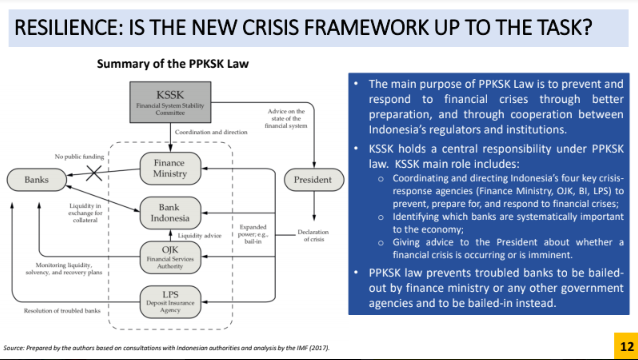

Several changes have been made to the role of Bank Indonesia in the crisis management protocol. Bank Indonesia no longer holds the role of the lender of the last resort, as banks now turn to OJK to seek recommendation to be treated by Bank Indonesia and the Committee of Financial System Stability (KSSK). This committee was established as a response to the Bank Century case, where a public official was criminalized due to the decision to bail out the bank. However, Febrio asserts that this new mechanism does not work well in an actual state of crisis, because a decision needs to be made in a matter of hours or even minutes. In addition, if the president does not declare a state of crisis, this mechanism will not be administered at all.

All in all, Febrio believes that it is in the best interest that Bank Indonesia returns to its role as the lender of the last resort. KSSK, on the other hand, should only become a medium for coordination, collaboration, and information sharing between agencies. Moreover, public officials should have better legal protection when they act in good faith in responding to financial and economic crises.

For the complete presentation and Q&A session, please refer to the video and materials provided.