On May 8th 2018, LPEM FEB UI hosted the FKP seminar in Salemba, Jakarta on the topic of Chinese investment and Chinese firms’ expansion in Indonesia, based on study conducted by Pierre van der Eng of The Australian National University. He started his presentation by explaining how business relations between Indonesia and China has growing rapidly in recent years. However, information about this relationship is lacking in consistent and public data. This condition may raise the potential for misunderstandings. Therefore, he aimed to explain in detail about the relationship based on a self-constructed database available in the public domain.

From China’s perspective, Pierre highlighted some facts such as the abundance of general studies on China’s FDI and how FDI influenced regional stability. From Indonesia’s perspective, he described lack of China influence since Indonesia opened up to FDI in 1967 until early 2002. In those years, foreign investment in Indonesia were dominated by Japan, South Korea, Taiwan, USA, and Europe. Since 2002, there has been a change in the inflow of FDI, where exports of resource-intensive commodity grew rapidly due to the China-led commodity boom.

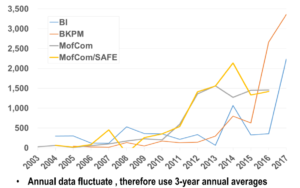

When measuring the significance of FDI from China in Indonesia, the study used several sources. From Indonesia, he estimated the FDI using data from BI and BKPM. Whereas in China, he used data from Ministry of Commerce and State Administration for Foreign Exchange. In addition, he constructed a 3-year annual average trend to measure Chinese FDI in Indonesia. He then compared the annual data from all database and find there are gaps (See graph below).

Pierre went on to explain some brief findings. The largest FDI in Indonesia are from Singapore, EU, and Japan. It is very likely a large part of FDI by Chinese firms come through Hong Kong to Singapore – it is probably that Chinese FDI to Indonesia between 2012 and 2016 reached $2.1 billion per year. Chinese FDI to Indonesia channeled through Hong Kong could reach $1.1 bln per year. Additionally, FDI projects from Chinese firms were dominantly related to mining, mineral processing, and manufacturing industry.

For the complete presentation and Q&A session, please refer to the videos and slides provided.