Reported by Adinda Rizky Herdianti

The last FKP seminar session hosted by Universitas Syiah Kuala was held on 29 March 2017 in Jakarta. The speaker, Nazamuddin who is also the Vice Rector of Universitas Syiah Kuala, presented his study in collaboration with Juanda entitled “The Economic Openness and Exchange Rate Stability: Autoregressive Distributed Lag Approach”.

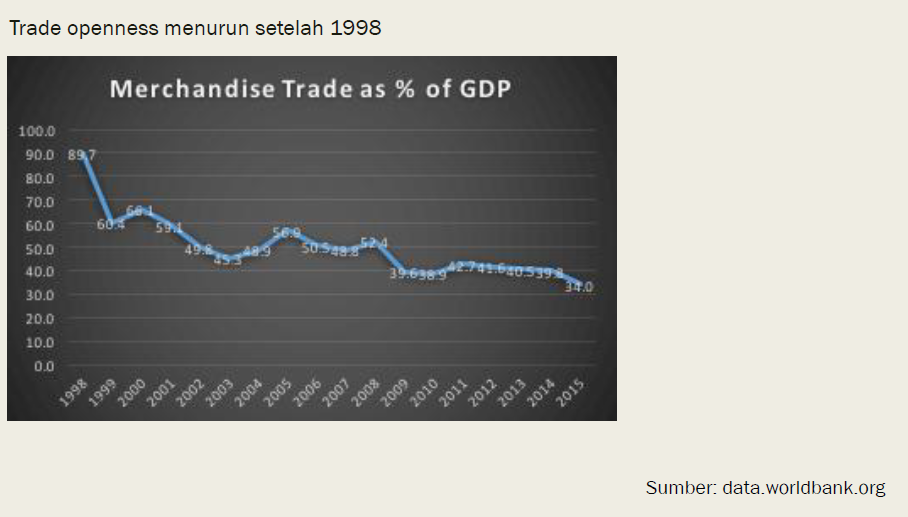

Since Asian Financial Crisis in 1998, Indonesia has become considerably more economically open as depicted in the ratio of trade to GDP, usually referred as the degree of trade openness. The increase in openness is also induced by Indonesia’s membership in several bilateral and multilateral cooperation such as ASEAN Free Trade Area (AFTA), ASEAN-China Free Trade Area (ACFTA), Indonesia-Japan Economic Partnership (IJEPA), and so on. Based on previous literature, economic openness is seen as an efficient mechanism to spur growth as it bears littler costs. However, other researches suggest that economic openness, which includes financial openness, does not necessarily lead to growth and stability. Instead, financial globalization persuades better corporate and public governance and provides incentive to establish better macroeconomic policy. As a small and open economy, Indonesia, which adopted free-floating exchange rate system in 1997, is prone to unstable exchange rate. This may cause difficulties in the budget planning, as exchange rate is one of the most important assumptions.

To investigate short-term and long-term effects of economic openness on exchange rate movement, the study uses autoregressive distributed lag (ARDL) approach where lags of both the dependent variable and explanatory variables are regressors. Economic openness in this study comprises of trade openness (share of export and import to GDP) and financial openness (share of FDI and primary income payment to GDP). The study also uses cointegration test, lag determination, and stability test to ensure a robust model.

Result shows that trade openness and financial openness do not have any significant effect on the exchange rate in the long-term. Rather than economic openness, policies imposed on real sector have greater impact to stabilize exchange rate. The study suggests that it is more important for the government to better focus on improving Indonesia’s financial market structure and governance to make Indonesia more appealing for trading and capital mobilization.