Reported by Adinda Rizky Herdianti

On 12 April 2017, LIPI hosted the second FKP seminar in which Yani Mulyaningsih (The Economic Research Center, LIPI) presented her study on the impact of syar’i microfinancing (Lembaga Keuangan Mikro Syaria, LKMS) on poverty reduction among agricultural households in Bogor, West Java, and Subagio Effendi (Directorate of Tax, Ministry of Finance – Indonesia) presented his policy paper regarding tax aggressiveness behavior in Indonesia.

Yani Mulyaningsih started the first session by revealing the fact that a small portion of adult population in rural area possesses an account in a formal financial institution; furthermore, the credit portfolio of the agricultural sector accounts for only 5%-6% to total credit. Low financial literacy and under-financing through formal financial institution had become an opportunity for smaller-scale financial institution such as LKMS to grow. There were 4000 new LKMS during 1990s to 2010. However, similar to most financial institution in Indonesia, LKMS faces constraint in capitalization due to the lack of source diversification. Based on previous studies, inefficiency can cause commercialization of LKMS, thus the goal of reducing poverty may not be achieved. This study breaks down the investigation into three parts: measuring the sustainability of LKMS using stochastic frontier approach, measuring the capability of LKMS to reach poor consumers using principal component analysis, and evaluating the impact of financing through LKMS on poverty reduction using propensity score matching. There are 19 LKMS that were selected by snowball mechanism to be the sample.

This study finds that the average efficiency score for all samples is relatively high (99,84%). However, such number might be rooted from the sample specification used in this study: only LKMS with well-organized financial report were selected, and this is generally associated LKMS with better management and efficiency. On the other hand, this study shows that an LKMS is more likely to give financing to relatively wealthier agricultural households. LKMS prefers to finance a more certain household due to the capitalization constraint, which leads LKMS to be more cautious in selecting consumer. The majority of LKMS consumers also received relatively small capitalization at least once. Yani Mulyaningsih concluded that LKMS have, in fact, limited impacts or even insignificant impacts, on poverty reduction in agricultural households. One of the audiences suggested Yani to study whether or not focusing on financing formal sector was a better option for LKMS instead of channeling the money to informal sector, which was more risky.

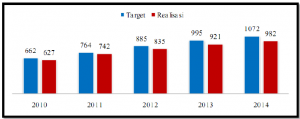

Next, Subagio Effendi presented his study regarding tax aggressiveness behavior in Indonesia Stock Exchange-listed manufacturing firms. The study is important since Indonesia is highly dependent on tax revenue to finance its development projects. However, tax realization is consistently below the target with tax ratio and tax buoyancy ratio declines each year. Considering the fact that Indonesia’s tax revenue source is dominated income tax, particularly corporate income tax, tax aggressiveness behavior shown by firms may increase fiscal risk.

This study uses effective tax rates as a proxy for tax aggressiveness. Effective tax rates can be measured by calculating the ratio of tax expense and pretax income and/or the ratio of total tax paid and pretax income. To investigate what factors that may influence such behavior, this study focuses on the managerial aspect of the firms such as the number of commissioner, gender diversity, managerial ownership, institutional ownership, and whether or not the firm utilizing audit service from the “big 4” (Deloitte, KPMG, PwC, and EY). The results show that the number of commissioner and institutional ownership do positively influence tax aggressiveness behavior of a firm. By contrast, using audit service from the “big 4” reduces tax aggressiveness behavior. Subagio summed up his presentation by mentioning the need to improve compliance risk management of a firm and better law enforcement.