Reported by Adinda Rizky Herdianti

Turro Wongkaren (Head of Lembaga Demografi or Demographic Institute) and Diana Stojanovic presented on the topic of anational transfer accounts on 18 May 2017. National transfers accounts (NTA) itself is a recently developed method to thoroughly measure the flow of an economy with regard to the change in its population structure. The topic is timely and necessary since Indonesia is preparing to experience ageing population in several decades ahead.

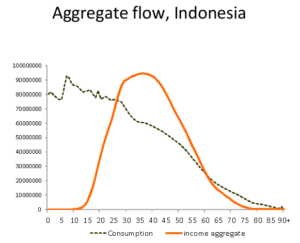

The starting point of NTA is founded on the observation that an individual uses and accumulates wealth for different purposes in each of his life stage, which is often closely associated with the well-known life-cycle hypothesis formulated by Modigliani in early 1950s. Indonesia is not an exception. Indonesia’s aggregate life cycle deficit (LCD) in 20112, defined as consumption less income, was negative in the late 20s until early 60s, reaching its peak figure at the age of 40s. It should be noted that income as a source of consumption funding, or referred as support system as well, has wider aspect that includes labor income, familial transfers, public transfers (social security system), interests and dividends, home owning, and dis-saving. LCD shows the bigger picture of population behavior that eventually leads to support ratio. Unlike the dependency ratio that directly compares number of productive and unproductive age group, yhr support ratio is based on effective labor and effective consumer, both are weighted sum of population using labor income age profile. In that sense, the support ratio provides valuable information on which age group is supporting the economy and which is the most dependent. Based on 2005’s life-cycle, Indonesia was said to enjoy a steep increase in the support ratio starting from mid-1990s and predicted to face sluggish increase beginning in 2020.

NTA does not stop at figuring out the role of each age group in the population; another key issue that can be investigated using this framework is the mechanism of wealth accumulation and how it will be distributed across different age groups. Wealth is defined as the present values of all consumption minus the present value of all labor income throughout the life course that consists of assets, transfer of wealth related to child rearing, and pension. The presentation puts emphasize on pension wealth since the pattern of wealth transfers to the younger age group is relatively more certain. Using population projection by United Nations and backward recursive model, Stojanovic found that elderly Indonesians generally rely their consumption funding on assets rather than transfers of wealth. However the growth rate of wealth accumulation is expected to be much slower in the future. Similar phenomenon also occurs at the youngest age group. Indonesian children will be supported largely by the public sector instead of familial transfers such as now.

Both speakers agreed that transferring wealth to children is a more productive and promising option considering the direction of Indonesia’s population structure. Apart from preparing children to be productive, public support for the children also gives additional fiscal space for parents to be allocated for asset accumulation activities. By having higher rate of assets accumulation, we can expect future elderly to rely on their own assets rather than on public transfers. Thus, the fiscal burden that may arise from ageing population can be mitigated.