The 11th Sadli Lecture was hosted by LPEM Faculty of Economics and Business Universitas Indonesia in collaboration with Indonesia Project at The Australian National University (ANU). It was held at Hotel Borobudur on 9th May 2017. The speaker of the lecture was Muhammad Chatib Basri (Indonesia’s Minister of Finance 2013-2014), while the keynote speech was given by Dr. Sri Mulyani Indrawati (Indonesia’s current Minister of Finance). Discussants of the event were Professor Mari Elka Pangestu (former Minister of Trade 2004-2011), and Reza Siregar (Senior Economist, IMF Institute for Capacity Development). The topic of the discussion was Dr. Basri’s paper entitle A Tale of Two Countries: India and Indonesia, a Lesson Learned from the 2013th Taper Tantrum.

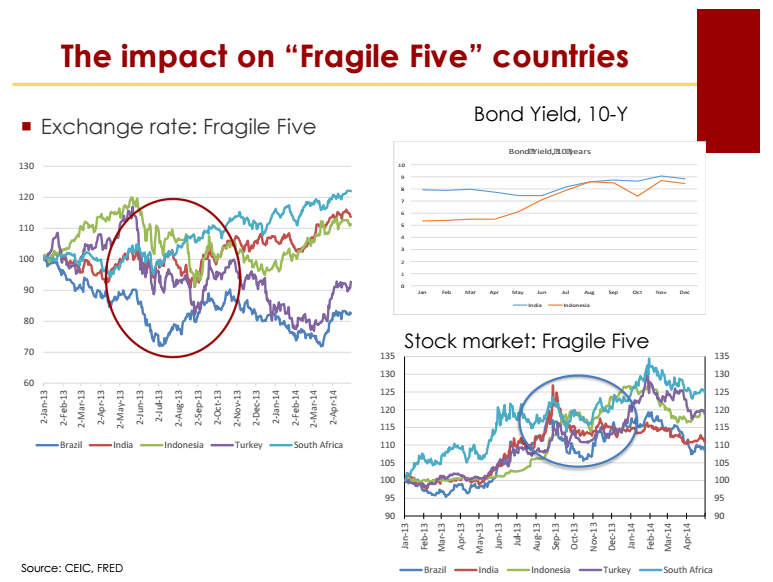

In her keynote speech, Dr. Sri Mulyani Indrawati state that the 2013th Taper Tantrum served as a reminder that Indonesia and India (categorized in the Fragile Five), like many other emerging countries, are exposed to free capital movement and, therefore, the risk that arises from it. Dr. Indrawati also stated that it is of great importance that identification of the economy’s vulnerabilities be conducted regularly. When a shock occurs, it is important to identify its transmission and its absorption, that is, to help mitigate the impact of the shock. Dr. Indrawati concluded her speech by conveying 3 important aspects required for effective economic policy-making in the face of an abrupt change in global economic condition, which included flexibility, responsiveness, and the credibility of the Indonesian economic policies.

The Lecture continued with Dr. Basri’s presentation of his paper. He started by sharing his past experiences with Professor Sadli, and his testimonies of Professor Sadli’s optimistic personalities. Dr. Basri started his presentation by mentioning Indonesia & India’s pre-Taper Tantrum conditions. He went on to mention both Indonesia’s economic similarities and differences to those of India. Before Taper Tantrum, these two countries were the darlings of foreign investors.

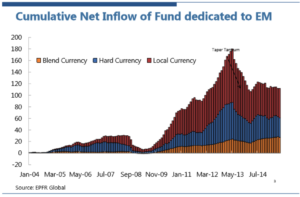

Indonesia and India received impacts from the tapering talk in 2013 because of the current account deficits in both countries. The current account deficit was a problem because the deficit had been financed by portfolios, instead of FDIs. During the Quantitative Easing (QE) period, Indonesia had been experiencing a huge foreign reserves increase due to the QE, contributing to a higher economic growth. Another implication of this increase in reserves is the exchange rate appreciation, which led to reduction in competitiveness, hurting the export. At the same time, budget deficit also steadily increased, because of the implementation of the fuel subsidy. All these conditions deteriorated the current account deficit at that time. The government handled the current account deficit by implementing some policies, such as expenditure reducing and switching policy, to depreciate the exchange rate. The similar turn of events also happened in India. But, Dr. Basri mentioned several factors contributing to the fact that India performed better than Indonesia after Taper Tantrum, some of which are the differences in terms of trade and openness.

Lessons learned from the 2013th Taper Tantrum included the need for the government to implement more economic reforms, and explore more macro prudential regulations as means to control capital flow. Another point is that high current account deficit is proven to be dangerous when financed by portfolio, or if FDI focuses only on domestic market. On the monetary side, Dr. Basri stated that the monetary authority should have been more responsive by raising the interest rate during the Taper Tantrum period.

The lecture was then continued by a discussion session involving present discussants. The first discussant, Prof. Mari Elka asked several questions, some of which concerned the political economy side of Indonesian policies during the Taper Tantrum period. Prof. Mari Elka also emphasized that communication of government policy is an important aspect in a policy-making process. The discussion then went on to Reza Siregar, who mentioned two main issues for the case of Indonesia regarding the Taper Tantrum. Those issues are the domestic fundamentals of the economy and macroeconomic policy’s credibility & flexibility. In the latter case (fiscal policy), Reza stated the importance of having counter-cyclical capacity in the government budget to mitigate the impact of shock occurrences. On the monetary side, regaining credibility and market trust is also of great importance.